We are finally starting to get some commentary in the financial media about the enormous upward wealth redistribution being engineered by Ben Bernanke and the Federal Reserve. Yesterday on CNBC’s “Squawk Box“, hedge fund billionaire Stanley Druckenmiller said of QE: “This is fantastic for every rich person, … This is the biggest redistribution of wealth from the middle class and the poor to the rich ever.”

For anyone who has been paying attention this statement shouldn’t come as a surprise. During this “recovery” the wealthiest 1% have captured 121% of the economic gains. How is it possible they received over 100% of the gains? Simple, everyone else has become poorer. But while income inequality is arguably the worst it’s ever been, it is really just part of an overall trend that has been going on for a couple decades.

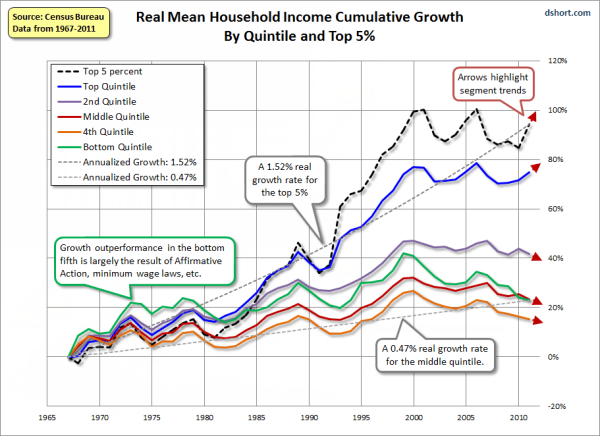

Here’s a chart put together by Mish showing the growth rates in real household income.

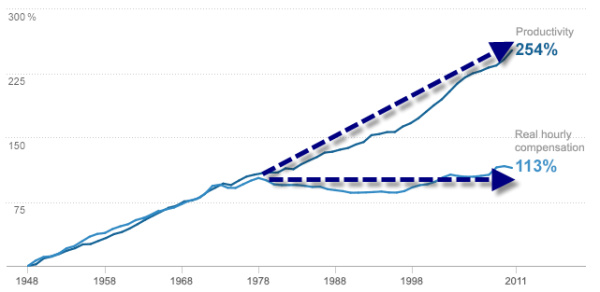

It isn’t that the economy hasn’t been growing. Worker productivity has certainly been increasing with technology, but the rise in productivity is not translating into a rise in wages as it should. The additional productivity is simply fattening the bottom lines of businesses.

Here’s a chart adapted from a Krugman blog post:

Now if you listen to the left, this result is, of course, the byproduct of unfettered free markets (that they suggest we actually have a free market is laughable). The problem is that there is nothing in general economic theory that would suggest a market economy would produce this result. Sure there will be some inequality on the market as people have differing talents and knowledge. People can earn large economic profits through entrepreneurship, but those abnormal profits are only temporary and fleeting as competition whittles them away fairly quickly — transferring the gains to everyone else through lower prices. How is this supposed to cause the gross examples of inequality that we’ve been witnessing?

The left has never offered up an even remotely plausible theory. It’s always presumed and unspecified forces mysteriously emerging from the dark underbelly of the market economy — and tax cuts! Of course, tax cuts don’t explain the divergence in pre-tax income.

It’s easy for the left to get away with blaming the free market. After all, the inequality is manifesting itself through market interactions. But just because a particular phenomenon manifests itself through the market, doesn’t automatically mean that it is the byproduct of market forces. It could just as easily be the byproduct of market distortions brought about by government intervention.

What I find breathtaking, however, is the degree to which the left as well as the mainstream of the economics profession blatantly deny that money printing by the Federal Reserve has anything to do with the distribution of wealth. They usually say something along the lines of, “Sure, under the right conditions, printing money will cause inflation, but your wages will increase by the same amount. So there’s nothing to see here.”

Now, there is a grain of truth in this statement. Over a long enough time frame it’s true that your wages will rise to match the increase in prices, but wages and prices don’t just rise in unison. Fed doesn’t just push a button causing the amount of money in everyone’s bank accounts to go up evenly. Instead, it spends the new money into circulation.

As a result, the income of some people will rise faster than prices, increasing their real income, while the income of others will rise slower than prices, decreasing their real income. The result in a redistribution of wealth from some people in the economy to others. Sure, in the long run real incomes will return to their pre-inflation levels (assuming everything has remained the same), but the distribution of wealth will have been forever altered.

There is no excuse for economists not understanding this either. These “distribution effects” have been understood since the very beginning of political economy. Even before Adam Smith, an economist named Richard Cantillon, having witnessed first hand the results of crankish monetary theories, wrote of the effect that increases in the money supply have on relative prices. “Cantillon effects” were common knowledge in economics all the way through the early part of the 20th century when the economics profession took a disastrous turn for the worse. I suspect that it was the growing obsession with analysis of macroeconomic aggregates coupled with the rise Keynesianism that caused analysis of this type of micro-level phenomenon to be dropped from the textbooks.

But nevertheless, people who deny that Cantillon effects exist are the economic equivalent of flat earthers.

A Thought Experiment

We can demonstrate why this is the case with a simple thought experiment: If it’s really true that money creation does not benefit some people at the expense of others, then why do people attempt to counterfeit money? If “prices rise, but income rises by the same amount” shouldn’t counterfeiting be self-defeating?

Obviously, counterfeiting does confer a real economic gain on the counterfeiter. That’s why people do it after all! Unlike everyone else who must contribute something of value to the economy prior to extracting value, the counterfeiter only extracts value and contributes nothing. Someone has to pay for the counterfeiter’s consumption. The resources don’t just materialize out of thin air. That someone is you and I and everyone else. It should be obvious that the counterfeiter benefits at our expense.

But the effects of counterfeiting don’t just stop there. Imagine if the counterfeiter goes to purchase a television from a retail store with his counterfeit money. Let’s assume for the sake of this example that the money is a perfect counterfeit, impossible to distinguish from real dollar bills. What happens in this situation is that the counterfeiter is adding his demand for the television (derived from the counterfeit money) to the demand of the retailer’s existing customers. Since the demand for the televisions has now risen, the retailer will do what every other businessman does in the face of rising demand — raise prices. He will sell the television for more than he otherwise would have and his profits will be greater than they otherwise would have been.

Notice that while the retailer’s income has risen, no other prices in the economy have gone up, yet. He can spend the new income in the economy at today’s (uninflated) prices. The retailer’s real income is now greater because of the actions of the counterfeiter. So we can say this retailer has also benefited from the counterfeiting. But since the price of the television has gone up, consumers who would have purchased a television will now have to pay more than they otherwise would have. Their real incomes are now lower. And, of course, it doesn’t stop there. When the retailer spends the new income, he increases the demand for the products he purchases, bidding up those prices as well. This merchant will also receive a benefit. As the counterfeit money continues to change hands, more and more prices around the economy will rise. As a matter of course it will take time for the new money to flow through the economy and bid up everyone’s income. Some people will have to pay elevated prices for a period of time before the new money eventually lands in their paychecks. Those people will be worse off.

The maxim here is that an increase in the supply of money, benefits the early spenders at the expense of the later spenders.

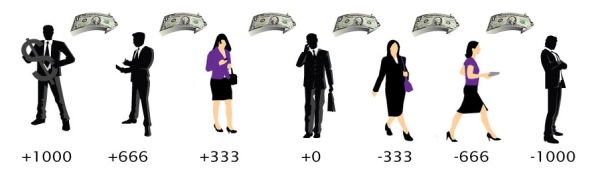

The above diagram helps to illustrate how those close to the source of the new money benefit from an income that rises faster than prices, while those further removed from the source see most prices rise before the new money reaches their income.

Admittedly, there’s only so much you can do in a diagram. In the real world, this process isn’t linear, rather the money fans out from the source changing direction and overlapping as it goes. But the underlying phenomenon is still the same.

Some people try to claim that inflation expectations will negate Cantillon effects. That all prices will simply adjust evenly or something like that. Those who think this are mistaken. It’s true that inflation expectations will play a role in determining the level of investment and interest rates, but they won’t affect prices for goods and services. Remember, it takes time for the wave of demand to move through the economy. A business cannot raise its prices until it’s customers raise their demand. But its customers can’t raise their demand until their income goes up, etc, regressing back to the source. If a business tried to raise prices before demand actually increased, its products would go unsold. A profit maximizing business will always wait to raise its prices until demand has actually increased. Expectations of inflation or not.

Let’s change the thought experiment a little bit. Suppose instead of buying a television with the counterfeit money, the counterfeiter buys bonds. Would this fundamentally alter our analysis in any way? No. The only thing that changes is who benefits from being close to the source — the bond dealer instead of the electronics retailer. Let’s change it one last time: Instead of some random guy buying bonds with counterfeiting money, this action is undertaken by Ben Bernanke and the Federal Reserve. Does anything change? Not at all. The economics are exactly the same. The only change is, again, who benefits.

In the modern financial system, the Fed spends the newly created money into circulation by buying (typically government) bonds from 21 privileged bond dealers (who also happen to be the largest banks in the world). These banks will typically lend the new money to various large corporations as well as the U.S. Treasury. And, of course, any “profits” that the Fed earns from its open market operations are ultimately paid out to the banks (who are shareholders in the Fed) as “dividends”. Any profits that remain after dividends are paid are remitted to the Treasury. Notice this isn’t any different than if a random counterfeiter earned interest on bonds paid for with counterfeit money.

So our economy ends up looking something like this:

Notice how the privileged elite are always at the front of the line while everyone else, including the middle and working classes, are at the back end. By injecting money into the economy in the above manner, the Fed is systematically redistributing wealth from the poor and middle class to the rich.

It was no less than John Maynard Keynes who said this of inflation (long before his general theory):

Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security but [also] at confidence in the equity of the existing distribution of wealth.—The Economic Consequences of the Peace, 1919

Currently, with QE∞, the Fed is printing a staggering $85 billion a month. That is essentially a free gift to the wealthy. And we wonder why income inequality is skyrocketing?

The left frequently tries to smear supporters of the free market by labeling our economic philosophy “trickle down economics”. If allowing people to keep their legitimately earned income constitutes “trickle down economics” then what is actively redistributing trillions of wealth to the rich in an attempt to “stimulate” growth?

What’s astonishing is that some of the loudest voices on the left condemning income inequality in America are the most ardent supporters of money printing. Paul Krugman, Joe Stiglitz, Brad DeLong, Robert Reich (who is soon to be releasing a film on inequality). All of them condemn the free market for inequality then turn around and agitate for more QE.

Denial of Cantillon effects is not limited to the left either. There are plenty of otherwise free market economists who have no problem with the Fed printing hundreds of billions of dollars. Scott Sumner and Tyler Cowen come to mind. Earlier this year, Sumner wrote a series of blog post on this topic after Sheldon Richman wrote about Cantillon effects in an article entitled How the Rich Rule, published in The American Conservative. It was stunning to see a professional economist make such basic errors and fail to get his head around the concept.

I suppose if you don’t actually consider the impact of monetary policy on the distribution of wealth until you are well into your career and after you’ve made a name for yourself arguing in favor of money printing, it’s going to be pretty hard to admit that you’re wrong.

The bottom line is that the Fed is behind the massive rise of inequality in recent decades as well as the horrifically lopsided “recovery”. If we are to fix the problem of inequality we need to stop listening to the flat earthers and bring sanity back to the monetary system.

Amazing post, love it.

Thank you!

Great post. Now, what are we able to do about it?

Switch to Bitcoin 🙂

really good post, it might be more impactful to the average reader if you specify what event caused the divergence of the productivity/real wages graph

I guess convertibility ended in Aug/71 – is this what you refer to?

> the rise in productivity is not translating into a rise in wages as it should

Productivity is measured as value of goods/services produced per value of labor input. That input is wages. Stagnant wages are the *reason* worker productivity has been going up and up. Conversely, if wages went up in lock-step with output, then productivity would be reduced.

My Thoughts Regarding Wealth Redistribution

Much of the rhetoric we’re hearing in the media today talks about the huge gap between rich and poor. Politicians on both sides discuss this issue, but neither seems to get to the root of the problem.

It’s true that the gap between the richest 10 percent of the country and the remaining 90 percent is growing, but from that point on, most politicians get it wrong.

The issue isn’t a matter of “wealth redistribution”, nor is it about protecting current tax rates. The real issue at hand is that most Americans just don’t understand the rules of personal finance. They believe what they hear from friends or people selling them products. It comes down to a lack of financial education.

Schools are turning out students who are not fully prepared for the real world. They might know the basics of history, science, math, and English, but there is no real teaching of money in school. I majored in economics and finance and I spent 25 years on Wall Street honing my skills, so I know firsthand how boring the topics can be. But I’m not talking about the heavy theory or detailed rules. I’m talking about simple personal finance — the money issues that will come up for people in the real world.

Pingback: By any other name: fiat currency edition | Peace and Markets

Pingback: Why bitcoin will help stop warfare | Peace and Markets

Pingback: The Prospects for a “Bitcoin Standard” | Escape Velocity

Outside of that which is needed to fund the government, government has no right to pick our pockets.